Stock trading is a combination of art and science. This requires a combination of analytical skills, market knowledge, and a keen sense of timing. Stock market investing is still a popular way to build wealth, with over 56% Americans owning stocks. Stock trading success is not a result of chance.

These strategies are great for both beginners and experienced traders. They will improve your trading skills and help you build a profitable investment portfolio.

This blog will take you on a journey through proven stock trading techniques that you can use today.

Stock Trading Strategies: Understanding their Importance

It’s important to know why a trading strategy is so crucial, whether you are new to the stock market or just looking to improve your skills.Trading without a plan is like Traveling without a map. You might get to your destination, but the journey will be long, stressful and filled with detours. A clearly defined strategy is helpful to traders.

- To minimize risks, set clear entry and exit areas.

- Market trends can provide you with opportunities to capitalize on.

- Do not make emotional decisions. This is one of the biggest pitfalls traders face.

Let’s now explore the most successful stock trading strategies to guide you in your quest to become a successful trader.

1. Day Trading Strategies

One of the most popular strategies for trading stocks is day trading. Day trading is the act of buying and selling stocks in the same day, to profit from price fluctuations.

How it Works:

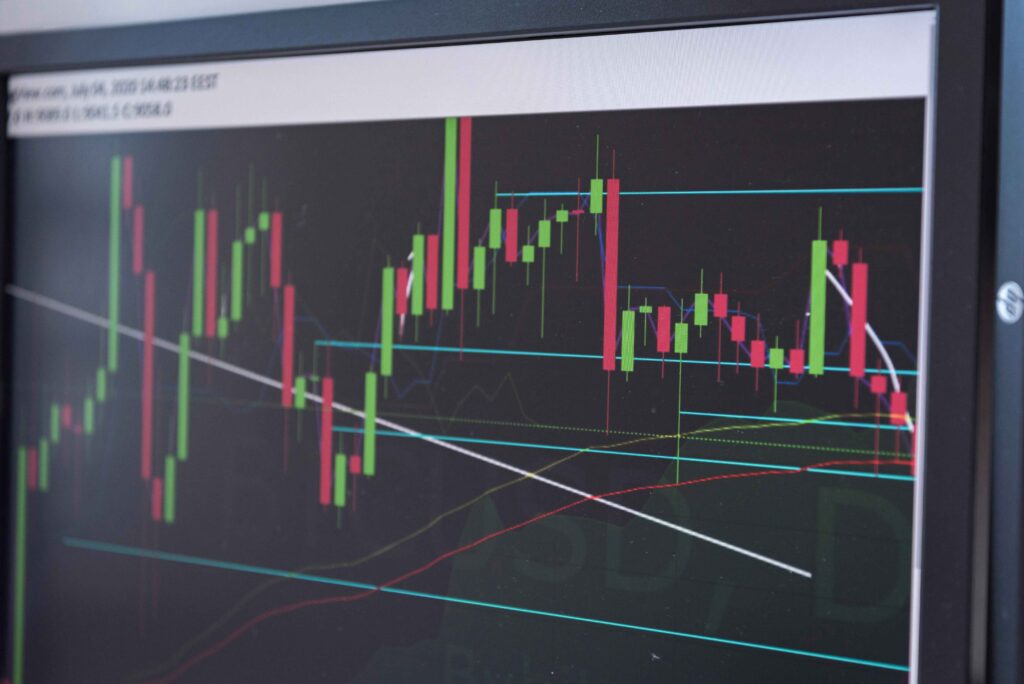

Day traders are interested in stocks with large price fluctuations throughout the day. The use of technical analysis to identify patterns and trends. Candlestick charts and moving averges help traders identify potential entry and exit levels.

Key Indicators For Day Trading

- he Relative Strength Indice: Indicates if a security has been overbought or oversold.

- Moving Average Convergence Divergence: Determines the strength of an asset’s trend, and any possible changes in momentum.

Pros:

- All positions are closed at the end of each day, so there is no overnight risk.

- You can gain quick profits if you know when to trade.

Cons:

- It is important to pay attention during the market hours.

- Risky due to market volatility and the rapidity of trading.

2. Swing Trading Strategies

Swing trading is a good strategy if you like to hold your stocks for a few days or even weeks. Swing trading is a strategy that aims to capture medium-term price changes by buying when the trend is low and selling at the high point.

How it Works:

Swing traders identify stocks poised for a significant move using tools like trendlines, resistance and support levels, and other indicators. Swing traders do not need to monitor the market constantly, but still need to be aware of broader trends.

Key Concepts

- Trend Following: Swing traders ride the wave of an asset until it begins to reverse.

- Chart Patterns. The head and shoulders pattern, as well as the double top/bottom pattern, is important in predicting future price movements.

Pros:

- Day trading is less stressful and time-intensive.

- This provides ample opportunities to capture medium-term price fluctuations.

Cons:

- Overnight market risks include news that can affect stock prices.

3. Position Trading Strategies

A position trading strategy involves holding stocks over a period of weeks, months or even years, depending on the market and stock trend. It’s more important to ride larger trends and be patient than to react every day.

How it Works:

Position traders consider fundamental analysis including company earnings, macroeconomic trends, and health of the business. They use technical analysis as well to confirm the long-term trend, making sure that the stock has an upward or downward trajectory.

Key Indicators:

- The 200-day Moving Average helps traders confirm long-term trends.

- Fundamental Metrics: The price-to earnings ratio (P/E), and earnings per share are important for assessing a stock’s potential.

Pros:

- Ideal for traders unable to monitor the market regularly.

- It is less stressful to spread out trades over a longer time period.

Cons:

- Capital is locked up for long periods of time, which limits liquidity.

- If not properly managed, significant downturns on the market can lead to losses.

4. Scalping Strategies

Scalping is the practice of making dozens or hundreds of trades a day in order to make small profits.

How it Works:

Scalpers take advantage of price fluctuations by executing quickly and precisely. Scalping is the practice of making dozens or hundreds of trades a day in order to make small profits.Since the margin of profit on each trade can be small, this strategy requires low-cost platforms.

Tool for Scalping

- Level 2 Quotes – Provides detailed price information on the market to help scalpers find their best entry and exit point.

- Time and Sales Data: Tracks real-time volumes of shares traded in different price ranges.

Pros:

- The sheer volume of trades can be very profitable.

- Trading takes place for a short time period, therefore there is limited exposure to the market risks.

Cons:

- Needs rapid and intense decision-making.

- If not managed properly, high transaction costs can reduce profits.

5. Momentum Trading Strategies

Momentum trading is an approach to stock trading where you try to profit from stocks that move in a certain direction and with a large volume.

How it Works:

Momentum traders are interested in stocks that have a strong upward or downward trend, which is usually triggered by earnings reports or news. When the stock is moving fast, they enter trades and exit when momentum slows down.

Key Indicators:

- Volume: A high trading volume indicates the strength of the stock movement.

- Moving Averages: Many traders use the moving averages of 50 days and 200 days to gauge momentum.

Pros:

- You can make large and quick gains by catching a stock at the beginning of its trend.

- Both rising and falling market can be used.

Cons:

- Close monitoring is required to exit the position at the correct time.

- A high volatility can increase the risk of sudden changes in direction.

6. Breakout Trading Strategies

Breakout strategy is about capturing large price movements after a stock has “broken out” of a price range. Breakouts occur when a stock moves over resistance or below levels of support, leading to high volatility.

How it Works:

Breakout traders watch stocks that consolidate or move in a narrow band. They enter a trade when the stock breaks through this range and bet that it will continue to move in the same direction.

Key Components:

- Support and Resistance: The traders identify the key levels of support and resistance where a breakout will likely occur.

- Volume Confirmation – A breakout must be accompanied by a high volume in order to confirm that it is not a false move.

Pros:

- Profit potential is high if the breakout results in a strong trend.

- It is easier to plan trades when you have clear entry and exit points.

Cons:

- False breakouts may lead to loss if the stock does not maintain its movement.

- Quick reaction time is required to make the right trades.

7. Reversal Trading Strategies

Reversal trading is the exact opposite of momentum. The reversal strategy aims to profit from stocks that show signs of reversing the current trend.

How it Works:

Reversal traders use indicators to identify potential trends reversals. Oversold and overbought conditions are often signs that a stock will reverse direction.

Key Indicators:

- Relative Strength Index: A RSI over 70 signals overbought situations, while a RSI under 30 signals oversold circumstances.

- Candlestick Patterns – Patterns such as the Doji and Hammer can indicate an impending reversal.

Pros:

- If you can catch the reversal in time, there is a high reward potential.

- It offers the opportunity to purchase stocks at a discounted price or short stock before it falls.

Cons:

- Risky, as it involves going the opposite direction of current trends.

- It is important to enter the building at the right time.

8. Dividend Stock Strategies

Dividend stock strategies are ideal for traders who want to generate passive income. This strategy involves buying shares from companies that regularly pay dividends. You can earn income, even if the price of the stock doesn’t increase significantly.

How it Works:

Dividend traders are interested in companies that have a long history of consistently paying dividends. The aim is to keep these stocks over the long-term while receiving regular dividends.

Key Metrics

- Dividend Yield is the annual dividend payment as a percent of stock price.

- Payout Ratio – The percentage of earnings paid as dividends by a company. Over time, a high payout ratio may not be sustainable.

Pros:

- The potential for capital appreciation is accompanied by a steady income.

- It is less risky than growth stock.

Cons:

- Dividend-paying stock tends to grow slower.

- If the company is facing financial problems, dividends may be reduced or even eliminated.

Stock market trading strategies are a dynamic mixture of art and a science. It requires a combination technical analysis of market conditions, market knowledge and disciplined application. Stock trading is not a random event; rather, it’s the outcome of a well-planned trading strategies that are designed to navigate through market fluctuations. By applying trading strategies such a day trading strategy, swing trading strategy, or position trading traders can better manage their risks and capitalise on opportunities. These techniques, whether you’re a newbie or you want to fine-tune your approach, will enable you to succeed in the stock market.